The Nasdaq finished the week down just about 4% and now sits right on its 10-week moving average as well as the $11,000 psychological number. After we saw a positive character change in the market last week, the bears took control again and left us in a do or die spot going into one of the most pivotal weeks of the year.

The Nasdaq added a distribution day on Tuesday and now sits below the 21 ema, and about 5% off its local high. The rising 50-day moving average could act as an area of support, however there is still an unfilled gap about 4.8% lower from Friday’s close.

The SPX remains in a Power Trend but has fallen back into no man’s land between the 50% and 61.8% Fibonacci retracements. Like the Nasdaq the SPX has also fallen below the 21 exponential moving average and has an unfilled gap about 3% lower from Fridays close.

One area I will be watching closely is right around $3860-$3870. This level has a confluence of the 38.2% Fibonacci retracement from this latest rally attempt off the lows, anchored VWAP from the low and it is right near the low of the November 10th rally day from the previous CPI report. The rising 50 day moving average will be in this same area in just a few days.

The dollar remains weak and is under all its key moving averages. While Yields are well off their recent highs, they pushed higher on Friday as the PPI report came in slightly above forecasts. The VIX has also continued to bounce near the $20 level where it has found support throughout the year.

Before we dive into my market outlook, current positions, and trading plan make sure you are subscribed so that you don’t miss any future updates!

Next week is without a doubt the most important week of the year. It promises to be full of volatility and the market could really go either way. We have the rare combination of CPI, FOMC and quad witching. All those events individually move markets, but this week we get them all together.

Tuesday, we get the CPI report, last month that came in lower than forecasts and ignited a massive rally. It’s going to be closely watched again to see if what the Fed is doing is taming inflation.

Then on Wednesday we have the FOMC announcement. It’s widely expected there will be 50 basis point hike, but nothing is guaranteed and what will matter more than the interest rate decision is not only what Jerome Powell says in his press conference but how he says it. Is he coming off hawkish or dovish?

I remain bullish on the market, however with the fury of events next week I am being cautious at the same time. It makes sense at this point to have the worst and best scenario planned out for anything on your watchlist.

Looking at the AAII to get a gauge on investor sentiment. This week’s bearish number increased again to 41.8% while the number of bullish participants also slightly increased to 24.7%. The neutral view was the only decliner dropping to 33.5%.

Current Positions: ENPH 0.00%↑ GFS 0.00%↑ ON 0.00%↑ PODD 0.00%↑ SHOP 0.00%↑

The overall portfolio was hurt this week as LULU dropped nearly 13% on earnings. Going into the report I had an 8% cushion going into the report and was able to sell quickly in the morning before things got ugly. The overall loss of capital wasn’t a lot due to having a cushion and cutting it quickly, but it always hurts to give back decent profits.

ENPH 0.00%↑ – Closed the week right in the middle of the range. Volume was below average, and the overall structure of this chart remains intact. After pushing to new all time highs last week, I expect this could make new highs again next week if the market reacts favorably to economic reports.

GFS 0.00%↑ – Showed relative strength this week closing up 1.41% while the markets were lower. Action continues to be healthy and constructive.

ON 0.00%↑ – Very light volume this week as this found support at the 10-week moving average. This continues to build out a handle of a cup with handle base, positive reactions next week could spark a breakout.

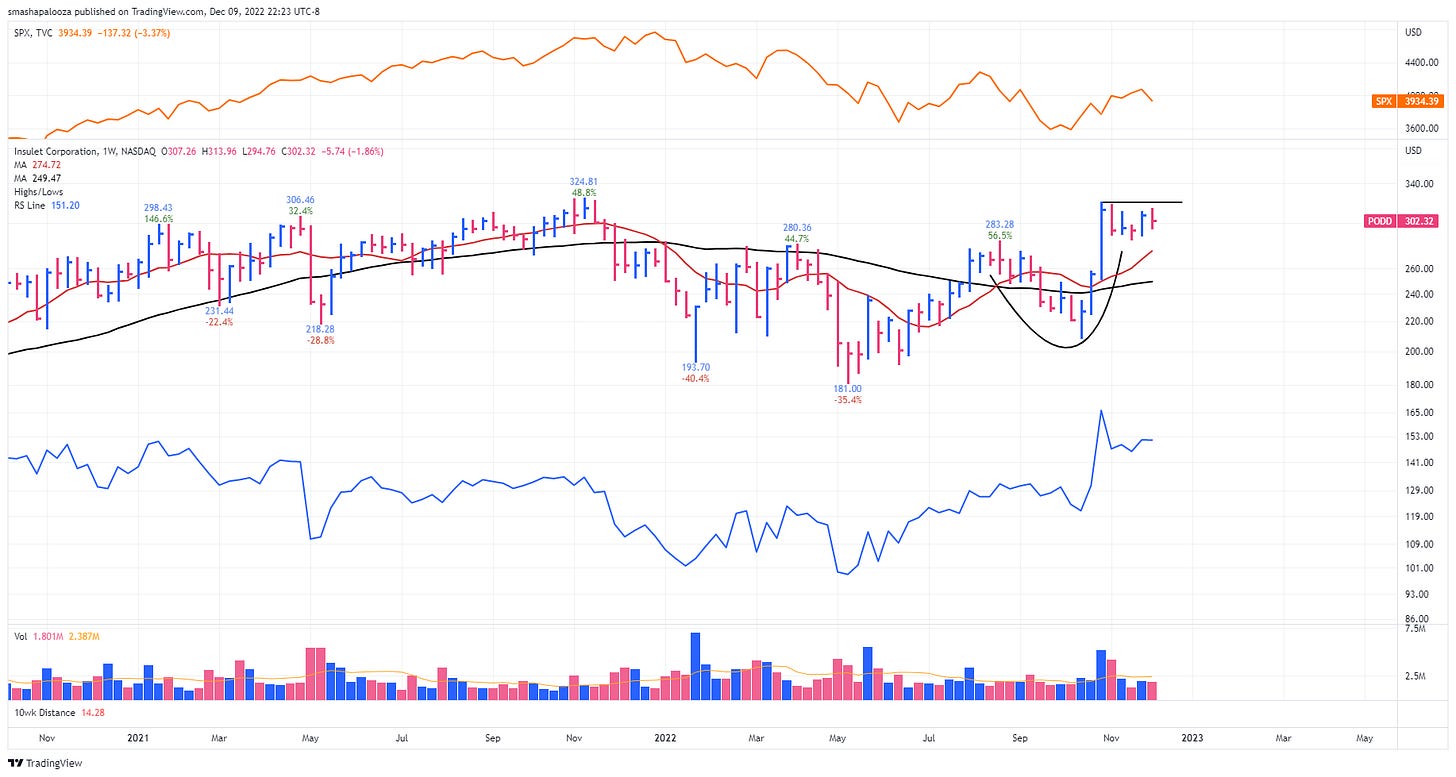

PODD 0.00%↑ – Completed the 5th week of a flat base. After launching higher from earnings this has gone on and formed a very nice flat base with a standard pivot of $320.

SHOP 0.00%↑ – Has now formed a cup with handle base. Although the pattern is much deeper than I prefer there are signs of accumulation starting to show up. This found support at the 21 ema as well as anchored VWAP from its last earnings report.

Watchlist: https://www.tradingview.com/watchlists/84325802/

With CPI, FOMC and Quad Witching happening next week I want to be prepared for anything to happen. I don’t plan on adding any exposure before the CPI report, but if the reaction is favorable, I do want to have a list ready of actionable ideas.

CELH broke out from a cup base last week and now has put in a high handle on lighter volume. The relative strength line is at new highs, and volume picked up as the stock made its way up the right side of its base. I will be watching CELH to pull back towards the 21 ema to initiate a position.

ON has formed a cup with high handle. Volume continues to decline as the handle forms. This bounced off the 10-week moving average and could break out to new highs if the market reacts favorably next week to economic events. I will add to my current position if this does break out.

PODD has formed a flat base after breaking out from its previous base on an earnings gap. The current base has only corrected 10% and has nice tight weekly closes. I will look to add to my current position in this on strength above the $320 standard pivot.

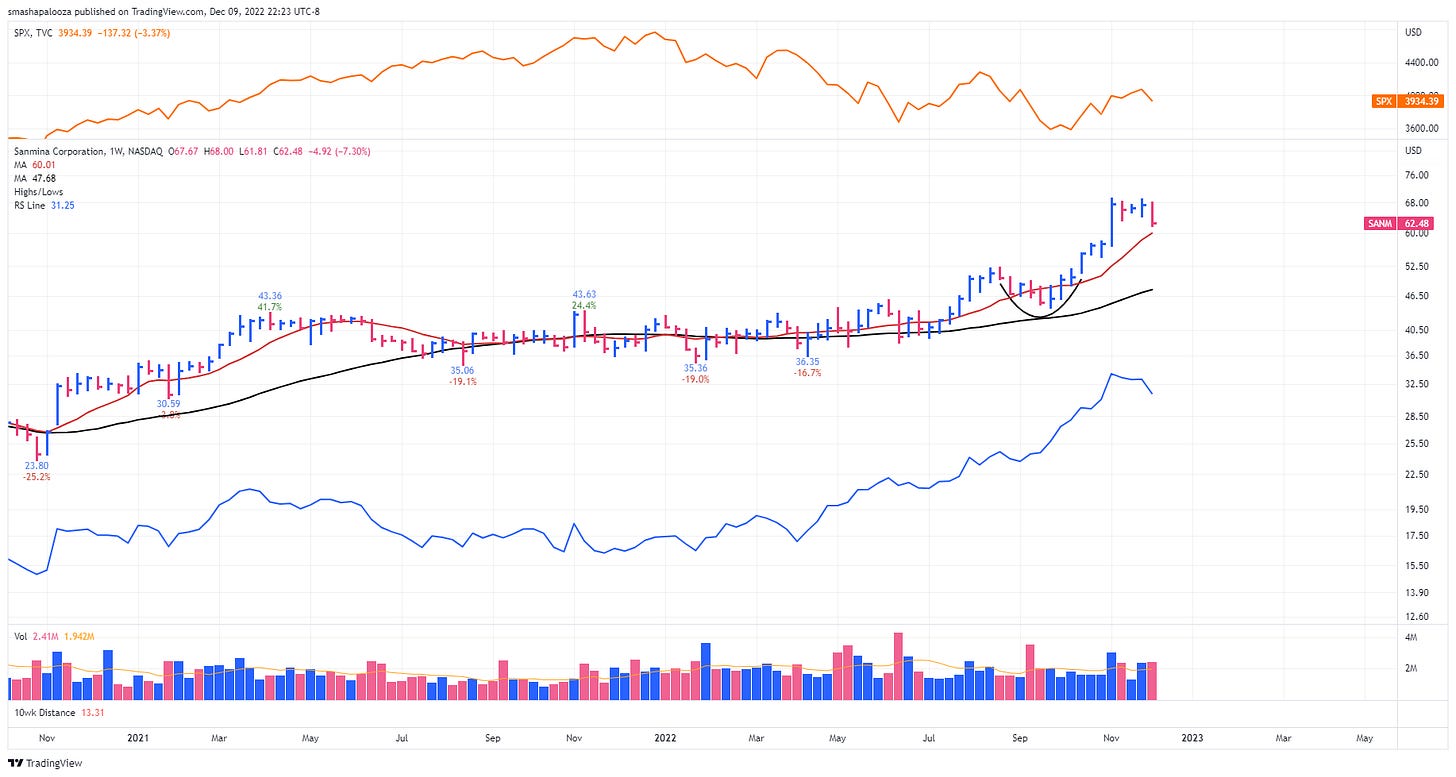

SANM broke out of a cup base back on 10/18 and has run up 32% since then. After going up 7 weeks in a row the stock went sideways for 4 weeks consolidating gains. I will be watching this now to come down and have its first touch of the 10-week moving average since breaking out.

Like SANM, SMCI broke out from a cup base and ran up 7 weeks in a row. I will be watching this one now as well to come down and have its first touch of the 10-week moving average since breaking out.

Stocks listed in Next Week’s Plan are stocks with strong fundamentals and showing good technical action that can offer a low-risk entry. Not every entry will trigger, but also just because a stock is listed here does trigger does not mean I will take the trade. Portfolio exposure, market health and other factors will also be considered.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.