2023 is off to a good start for bulls, and this week on Thursday, the market flashed a rare but powerful signal known as Breakaway Momentum or a Walter Deemer Breadth Thrust. This signal has only happened 25 times since 1945 and has led to a 20% gain on average in the S&P a year later.

Before we dive into Breakaway Momentum and the current market make sure you are subscribed so that you don’t miss any future updates!

This Breakaway Momentum signal occurs when the ten-day total advancers on the NYSE are greater than 1.97 times the ten-day total decliners on the NYSE. On Thursday, the 10-day ratio of advances vs. declines was 2.14, which is well above the 1.97 threshold needed to achieve breakaway momentum.

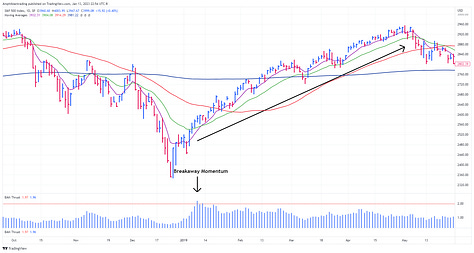

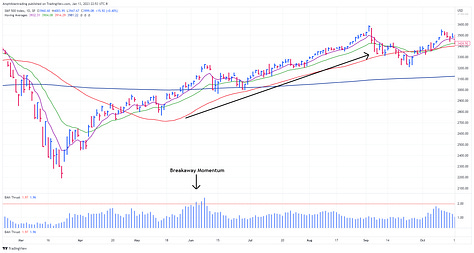

Looking at previous times this signal occurred you can see it has led to powerful moves. In June 2020, the market went up about 15% in 90 days. In January 2019, the market moved up about 15% in 4 months after breakaway momentum occurred. In 2009, this signal occurred three times and produced nice returns each time.

In addition to this signal, we are seeing positive price action as well. Both the market signal and the net highs / lows signal of the Market Stop Light indicator are green, signifying that price is over a rising 21-day exponential moving average and there has been at least a 3-day streak of net highs. On top of that the 50-day moving average has started trending up and price is back above the 200-day moving average, which has acted as strong resistance all throughout 2022.

However, it's worth noting that price is sitting just below a downtrend line from the top where it was rejected multiple times, so we'll have to see if this is the time we finally break through it.

Overall, the market looks set to move higher from here with positive price action in the indexes and leading stocks. The dollar, interest rates and the VIX continue to move lower and breadth is steadily improving.

To see how breadth is improving and the stocks I am keeping a close eye on make sure you watch the video below.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.