With a developing banking crisis and economic data recently pointing towards inflation moving higher again, Jerome Powell and the Fed are stuck between a rock and a hard place. Do they continue raising rates to fight inflation or do they pause to prevent bank runs and restore confidence.

Before we dive into more analysis make sure you are subscribed so that you don’t miss any future updates!

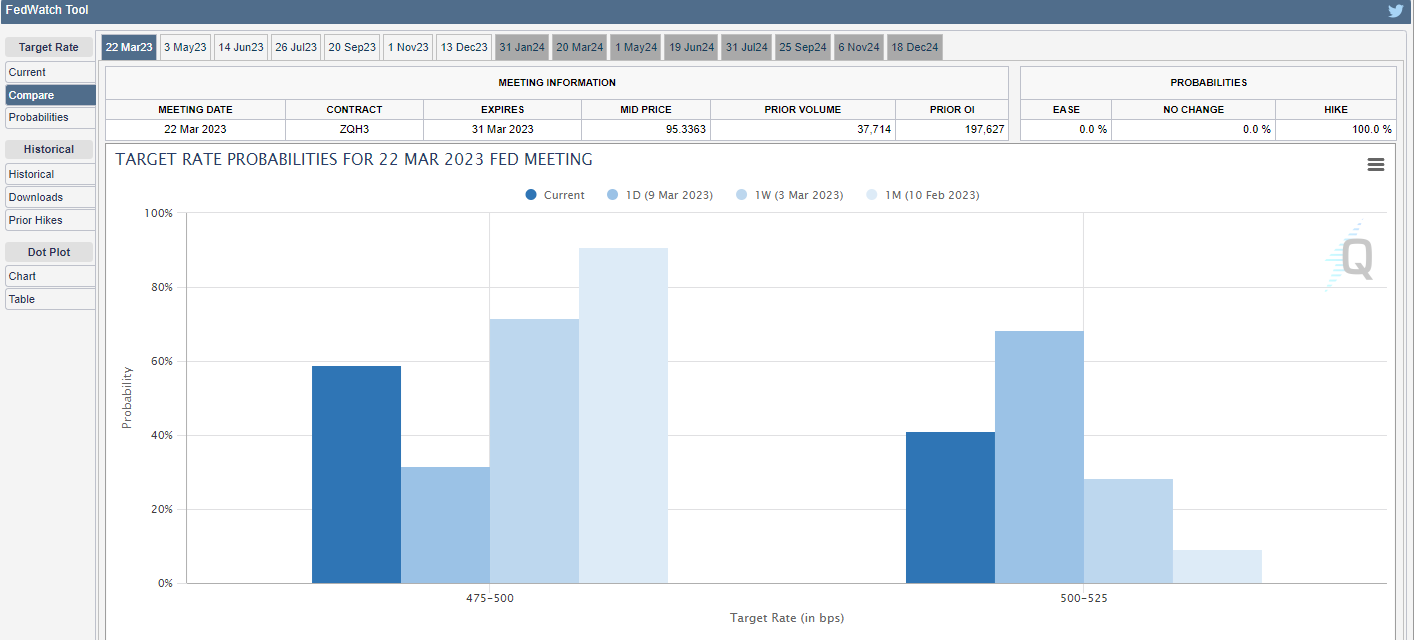

Taking a look at the CME FedWatch tool you can see just how quickly the projected rate hikes change. As of today the market sees a 59% chance of a quarter point hike versus a 41% chance of a 50 basis point hike, while just yesterday those odds were completely different with a 68% chance of a 50 point hike.

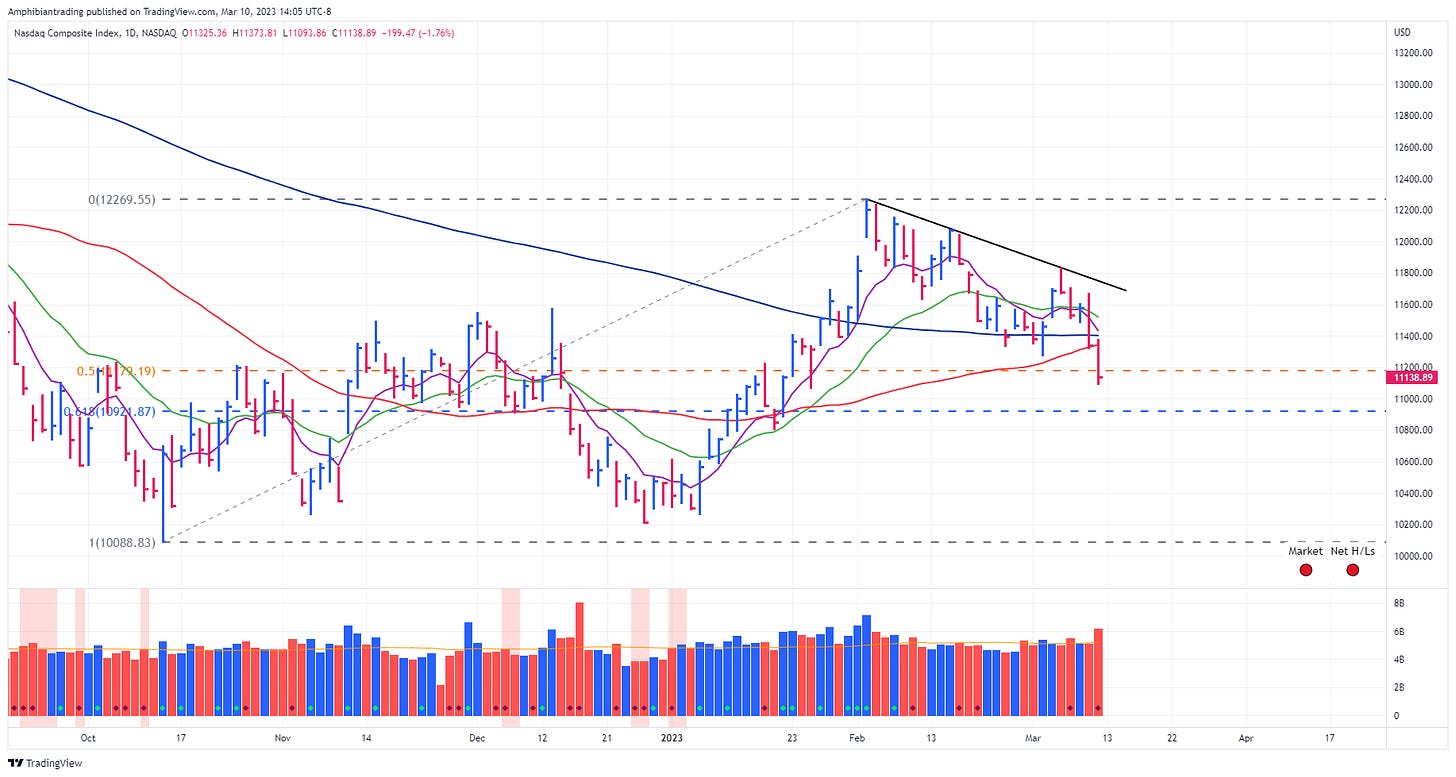

Moving over to the Nasdaq, the bears got their way this week as the index plunged over 4% and closed right near the lows. After a Monday morning gap up ran right into resistance at a newly formed trendline, the market pretty much went straight down all week, picking up two distribution days along the way.

The Nasdaq sliced thru all of it’s moving averages and saw consecutive days of net lows turning both signals of the Market Stop Light Indicator to red, signaling caution is warranted. It continues to get worse as the Nasdaq also sliced through the 50% Fibonacci retracement from the October low to February peak, leaving the .618 retracement as a final stand for the bulls.

The one positive was that the Nasdaq managed to have was a golden cross on the weekly chart with the 10 week moving average crossing above the 40 week moving average.

Until the market gets some clarity on the banking crisis and what the Fed might do, this will continue to be a risk off market. Equities, the dollar, and yields were all lower, while the only thing positive was the VIX, signaling more uncertainty ahead.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.