Over the last few weeks, we’ve witnessed the Nasdaq 100 (QQQ) steadily climbing higher, while smaller indexes like the IWM & QQQJ, continued to display weakness. While the QQQ continues to lead, we finally saw a step in the right direction for small and mid cap stocks.

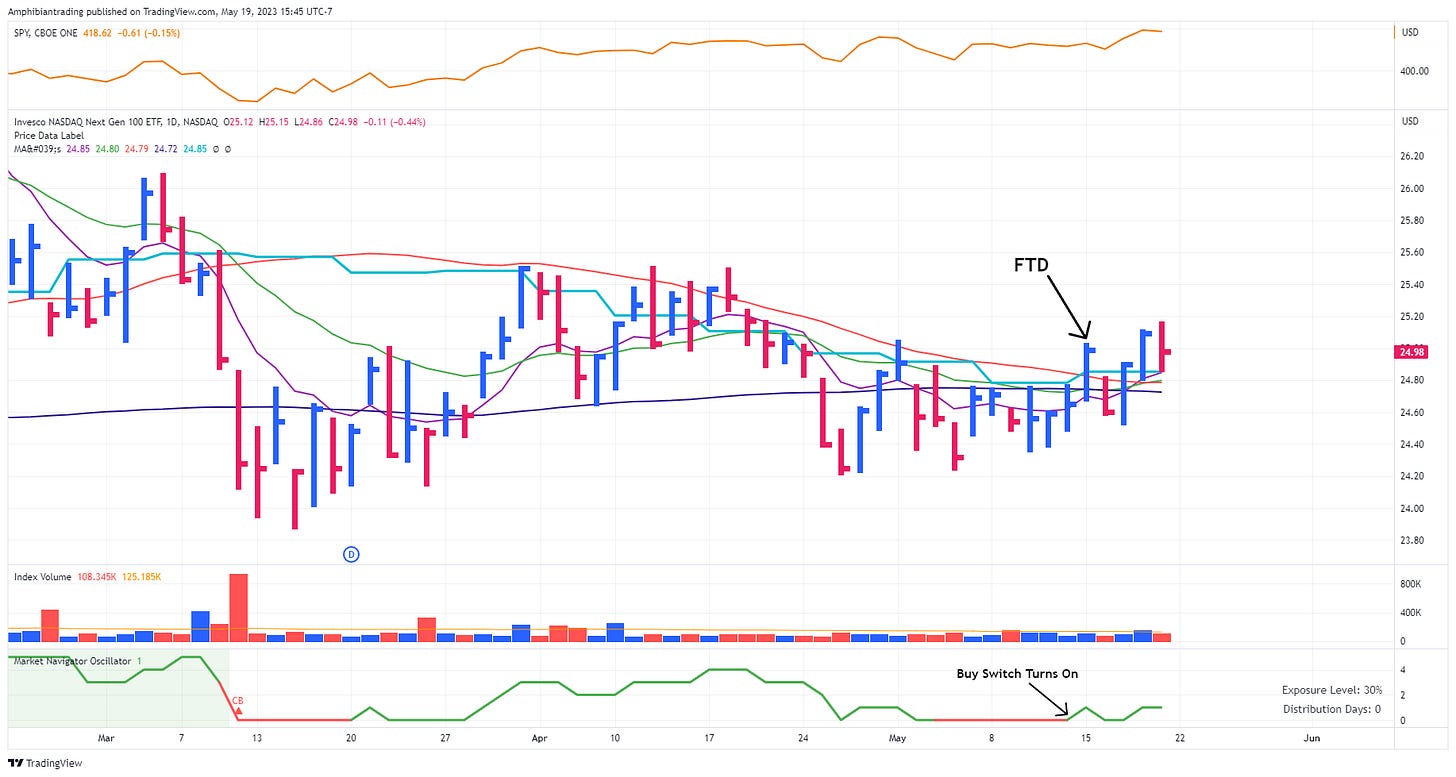

The QQQJ had follow-through day on Monday, gaining 1.38% and reclaimed all of it’s key moving averages. What looked to be another false move higher based on Tuesdays price action, was negated with consecutive days of favorable price action on higher volume Wednesday and Thursday. Additionally, on Friday, the index found support at the 10-week and 8-day exponential moving averages.

If you enjoy my newsletter make sure you subscribe so you don’t miss any future updates!

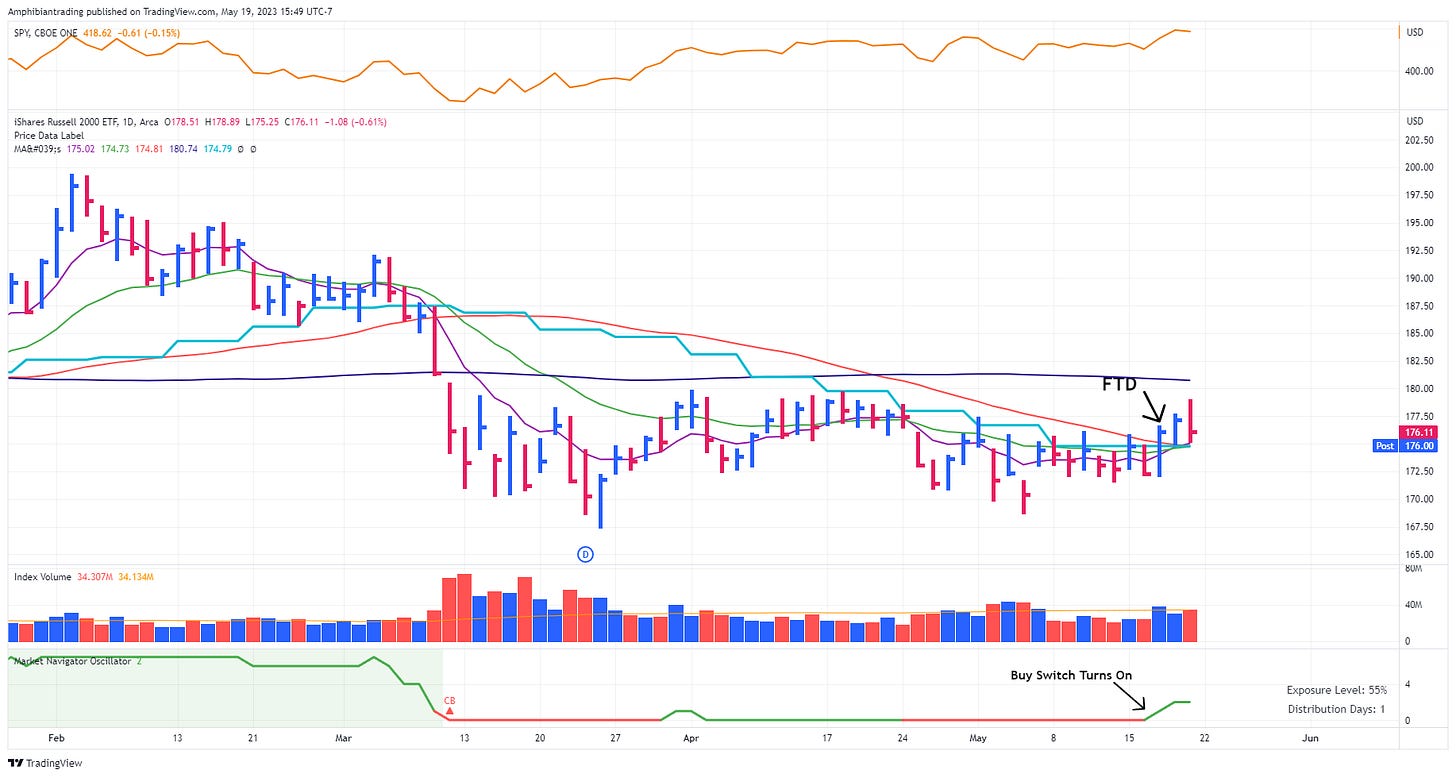

Although the IWM is still trading below its 200-day moving average, it also staged a follow-through day on Wednesday, while also reclaiming other key moving averages. In addition to the encouraging price action, the return of net highs to the market is a positive sign. Net highs indicates broader participation in the market, and a continued streak of net highs would further increase the chances of a sustained rally.

In order to see net highs continue we will need to see stocks setting up and breaking out. After reviewing charts this week, I feel there are enough stocks forming proper bases, moving up the right side of their base, or even breaking out with significant volume. In the video below I will review the indexes as well as 5 stocks that could be actionable next week!

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.