The markets had a short trading week with the a half session Monday and the 4th of July holiday on Tuesday. However, there was still plenty of market action. Before we get into the action make sure you are subscribed so that you don’t miss any future updates!

As the market continues to perform well, it is important to be aware of the current sentiment readings. While sentiment indicators can provide valuable insights, we have to remember they are only secondary indicators and price and volume remain the primary factors to consider. With that said, let’s take a look at the sentiment readings.

One of the most popular sentiment indicators is the weekly AAII survey. This weeks reading revealed a surge in bullish sentiment. At 46.4%, the number of bullish participants has reached its highest point in a year. This reading also surpasses the historical average of 37.5%.

Along with this, bearish sentiment remains relatively low compared to its historical average.

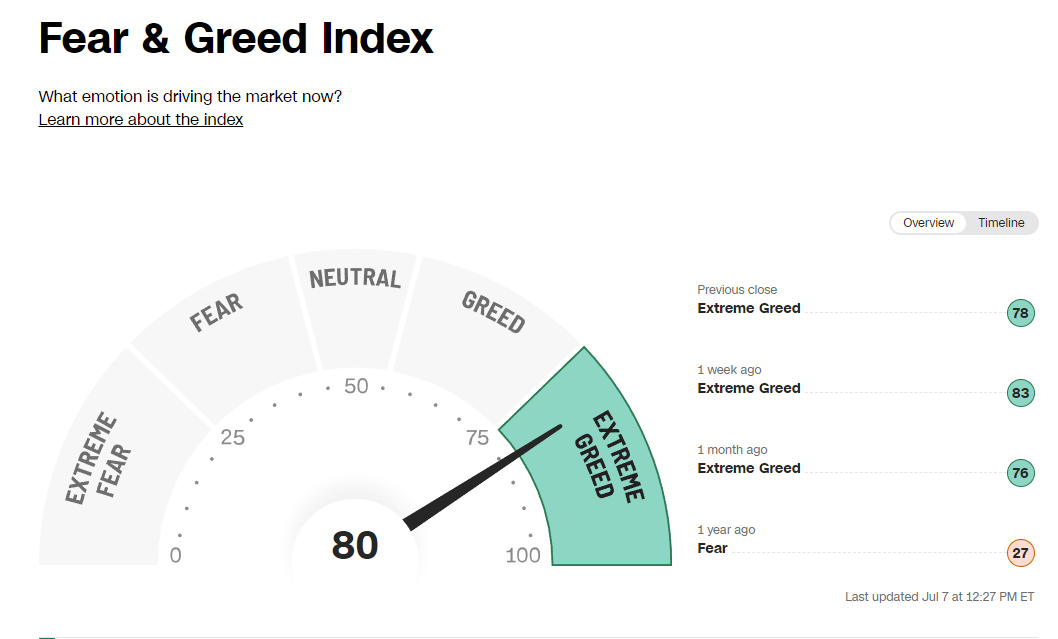

Another sentiment gauge, the Fear Greed Index, currently indicates extreme greed in the market. However, it's worth noting that the index has remained at this level for the past month.

While high levels of bullish sentiment do not necessarily mean an imminent market crash, often, when market sentiment becomes heavily skewed towards one direction, there can be a sudden shakeout that reverses sentiment and brings it back towards neutral. Sentiment can also be corrected over time as the market consolidates, wearing out the excessive sentiment.

Market Navigator

The Market Navigator remains in a Power Trend as the Nasdaq remains above the key 21 and 50 day moving averages.

The distribution day count is now elevated to 5, right below a full distribution count of 6.

The exposure count came down by 1 point this week to a 6.

In the video below I review the current market, talk about the bullish sentiment and review what I look for in leading stocks in relation to their 10 week moving average.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.