While recent market action has been positive, the market remains news-driven, and the recent strength of the dollar and interest rates may slow down the recent rally. Nonetheless, analyzing historical patterns and signals can offer valuable insights as to what is healthy and what is abnormal.

As traders we are always on the lookout for signals that may provide an edge and indicate potential market movements. One such signal is the Walter Deemer Breakaway Momentum Thrust, which occurred on January 12th of this year.

Before we dive into my full market analysis make sure you are subscribed so that you don’t miss any future updates!

Since that signal, the Nasdaq has risen as much as 11.5%, with a recent pullback to the 21 exponential moving average of approximately 5.25%, which is similar to previous occurrences of the signal, including in June 2020 and three times in 2009.

In addition to the breakaway momentum thrust, there has been a rare signal of three follow-through days in a row, which also occurred in November 2020 and April 2009 (pictured below), with similar pullbacks before the market continued to rise.

Overall, the Nasdaq remains in a power trend, with both signals on the Market Stop Light indicator showing green, and many stocks have seen five or more consecutive weeks of gains, which can indicate potential leaders in the market.

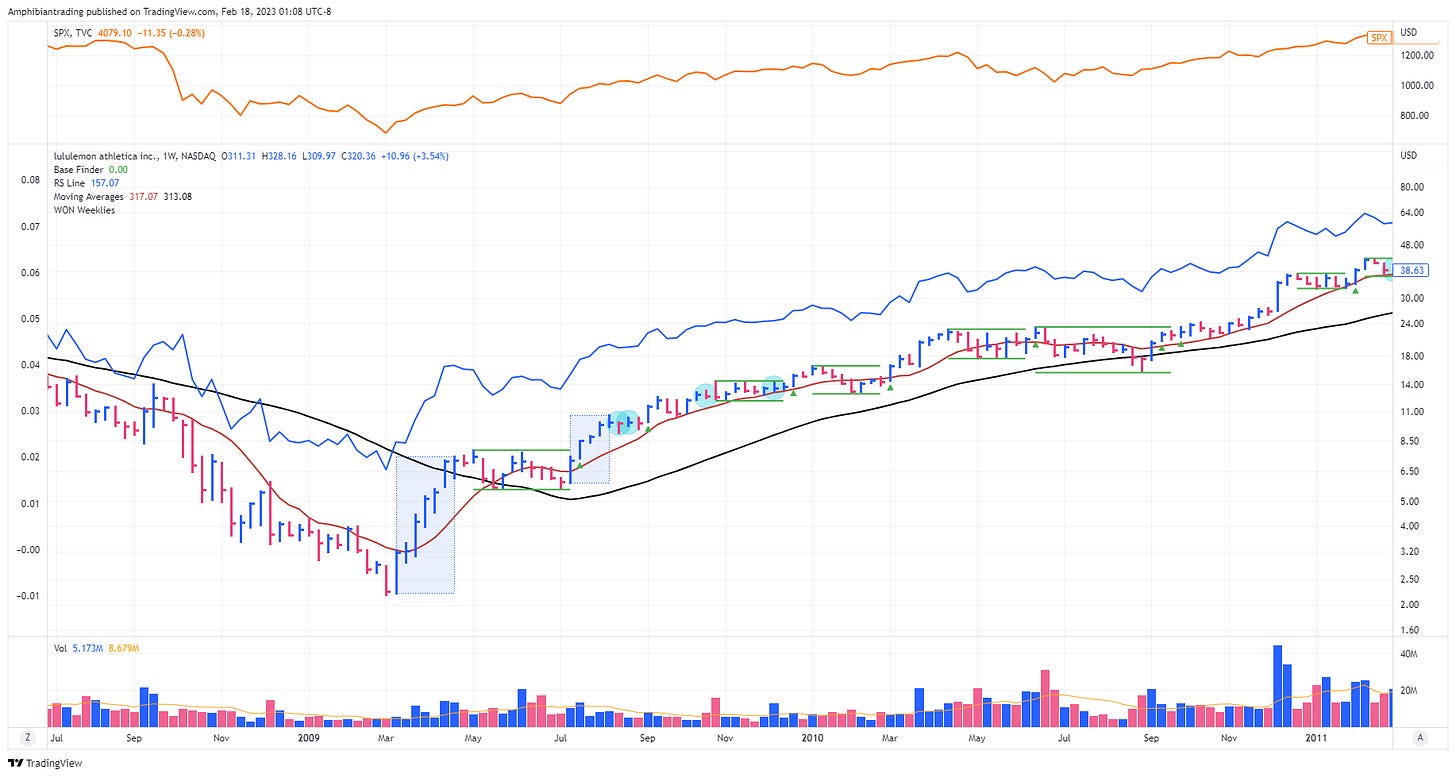

Looking back at 2009, the year coming out of the Great Financial Crisis, there were stocks like Lulu Lemon, Apple, and Tempur Sealy that saw similar patterns of consecutive weeks of gains followed by quick consolidations before continuing to move higher.

We’ve recently seen this consecutive weeks of gains in a handful of stocks. Using 2009 as a blueprint, we could potentially see low-risk entry points on substantial moves higher.

The video below covers everything talked about here in more detail as well as two of my favorite stocks that could potentially lead the next leg higher.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.