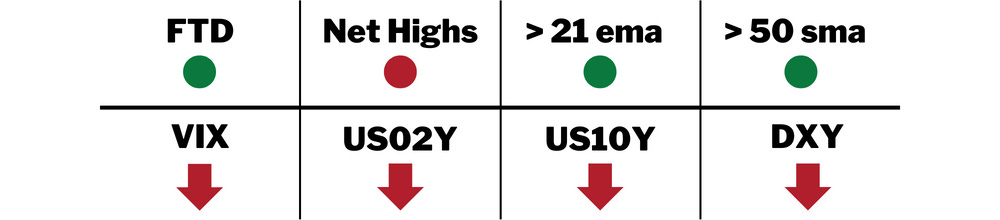

The action in the Nasdaq remains constructive as we continue to build out this current rally attempt. The Nasdaq traded down to the 21 ema today before bouncing and closing higher right near the top of its daily range above the 8 ema. Volume was light overall; however, it did come in higher than yesterday giving us an additional follow through day. This is the 6th follow through day of the current rally attempt, while we only have 1 distribution day.

The SPX rallied nicely today after finding support at the 8 ema yesterday. It now sits above the 4000 psychological level and right below 61.8% retracement level. The bulls will be looking to flip the 4000 level to support and to push through the 61.8% retracement.

As you would expect, with a strong day in the market the dollar and yields both fell. The dollar continues to build a bear flag and found resistance at the 8 ema today. The 2-year yield is stronger than the 10-year yield which is also forming a bear flag below all of its moving averages except the 200 day. The VIX also continued to decline to the lowest levels since August.

Current Holdings: ANET 0.00%↑ , ENPH 0.00%↑ , LULU 0.00%↑ , ON 0.00%↑

With the strength in the market today, my holdings acted as excepted except for CELH. CELH was weak all day and I quickly sold during morning weakness. CELH traded much lower throughout the day, once again stressing the importance of honoring your stop. ANET, ENPH, LULU, and ON all found support near their 8 ema early in the session and climbed higher throughout the day. ENPH finally pushed above the $313 level and missed a new all-time closing high by $0.18. Volume wasn’t great, but I do except this to hold above that level now.

My focus remains on finding additional low risk entries in the coming days and weeks to size up into my current holdings. As always risk management is the number one goal so I will keep an eye out for any red flags.

CELH continues to build the right side of its base after reclaiming the 10-week moving average. This remains volatile and stuck in a channel. There is a kicker pattern set up going into tomorrow. A gap up above today’s opening price of $96.25 would trigger the kicker. The stop would be today’s close. I don’t plan on taking this trade as I was just stopped out of this today.

My main focus. GFS is a young IPO that has finally formed its first proper base. The weekly chart shows tons of accumulation and a strong volume profile. This broke out of a 13-week 29% deep cup base last week and closed right at the highs. I will be watching this to pull back to the 21 ema to initiate a position. It may not happen, but if it does, I will be ready to pounce.

WING broke out of it’s most recent base with a strong earnings gap. After consolidating recent gains it came down and touched the 21 ema today before reversing and closing near the highs. If this can push above todays highs I will look to start a position. It will need to open in today’s candle or very close to the high if it gaps, I don’t want to chase gap ups yet.

Stocks listed in Tomorrows Plan are stocks with strong fundamentals and showing good technical action that can offer a low-risk entry. Not every entry will trigger, but also just because a stock is listed here does trigger does not mean I will take the trade. Portfolio exposure, market health and other factors will also be considered.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.