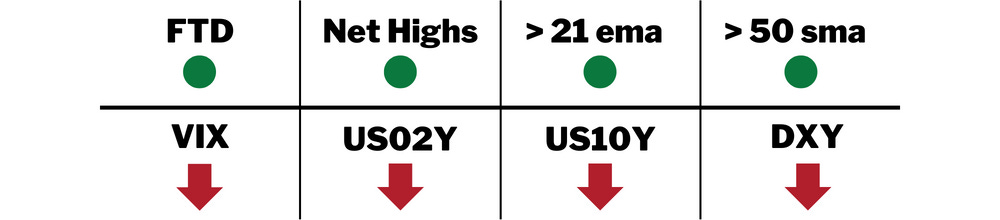

The Nasdaq had another constructive day as it rallied just about 1% into the Thanksgiving Holiday. Volume remained light overall but did come in above yesterday’s level. The Nasdaq managed a low above the 21 ema, but most importantly was able to flip back to net new highs.

The SPX also rallied today and managed to push through and close above the 61.8% retracement level. I would like to see this flip to support now that the resistance is broken. With today’s close the SPX triggered a power trend and sits less than 1% below its 200-day moving average. The June to August rally ended with the SPX touching the 200-day. We will see if this time is different.

Power Trend Criteria:

Low above the 21 ema for 10 days

21 ema is greater than the 50 sma

50 sma is in an uptrend

Close up on the day

Like yesterday, as you would expect, with a strong day in the market the dollar and yields both fell. The dollar was rejected at the 8 ema and broke down from the bear flag. The 2-year yield is holding right near key moving averages while the 10-year yield also broke down from a bear flag after being rejected at the 8 ema. The VIX also continued to decline to the lowest levels since August.

Current Holdings: ANET 0.00%↑ , ENPH 0.00%↑ , LULU 0.00%↑ , ON 0.00%↑ , WING 0.00%↑

My current position continues to act well. As discussed in last night’s plan I initiated WING as it pushed above yesterday’s high. It did close right below my entry and the 8ema, but I think the risk to reward ratio is still positive here. ANET continued its recent advance and made new rally attempt highs since breaking out of its base. ENPH was the loser of the day, but the action was still constructive as it stayed above the pivot and $313 level, volume was light, and it had its narrowest daily range in quite some time. LULU has set up a low risk spot to add to my position. I will discuss below. After morning strength ON faded throughout the day and had a sluggish close but was still positive less.

My focus remains on finding additional low risk entries in the coming days and weeks to size up into my current holdings. As always risk management is the number one goal so I will keep an eye out for any red flags.

My main focus still. GFS is a young IPO that has finally formed its first proper base. The weekly chart shows tons of accumulation and a strong volume profile. This broke out of a 13-week 29% deep cup base last week and closed right at the highs. I will be watching this to pull back to the 21 ema to initiate a position. It may not happen, but if it does, I will be ready to pounce.

Since breaking out of its cup with handle base LULU has held above the breakout level and the left side high of the base. That is something that we haven’t seen much of this year. LULU has formed a nice flag with a multitouch trendline. If LULU can push above the trendline I will look to add to my position.

I initiated this today, however the set up is still valid as it closed slightly below the pivot. WING broke out of it’s most recent base with a strong earnings gap. After consolidating recent gains it came down and touched the 21 ema before staging an upside reversal. If this can get back above yesterday’s highs it will trigger a pullback buy.

Stocks listed in Tomorrows Plan are stocks with strong fundamentals and showing good technical action that can offer a low-risk entry. Not every entry will trigger, but also just because a stock is listed here does trigger does not mean I will take the trade. Portfolio exposure, market health and other factors will also be considered.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.