There is no doubt that Halozyme Therapeutics (HALO) has been one of the strongest stocks in the market as of late. While the market has been going down all year, HALO has showed tremendous relative strength and is up close to 25% ytd as I write this. Not only is HALO positive, but every single time the S&P 500 has gone on to make a new low, HALO has made a higher low.

While the markets continued to move lower, HALO put in a nice uptrend of 31% before going onto form what would be a beautiful stage 1 five-week flat base.

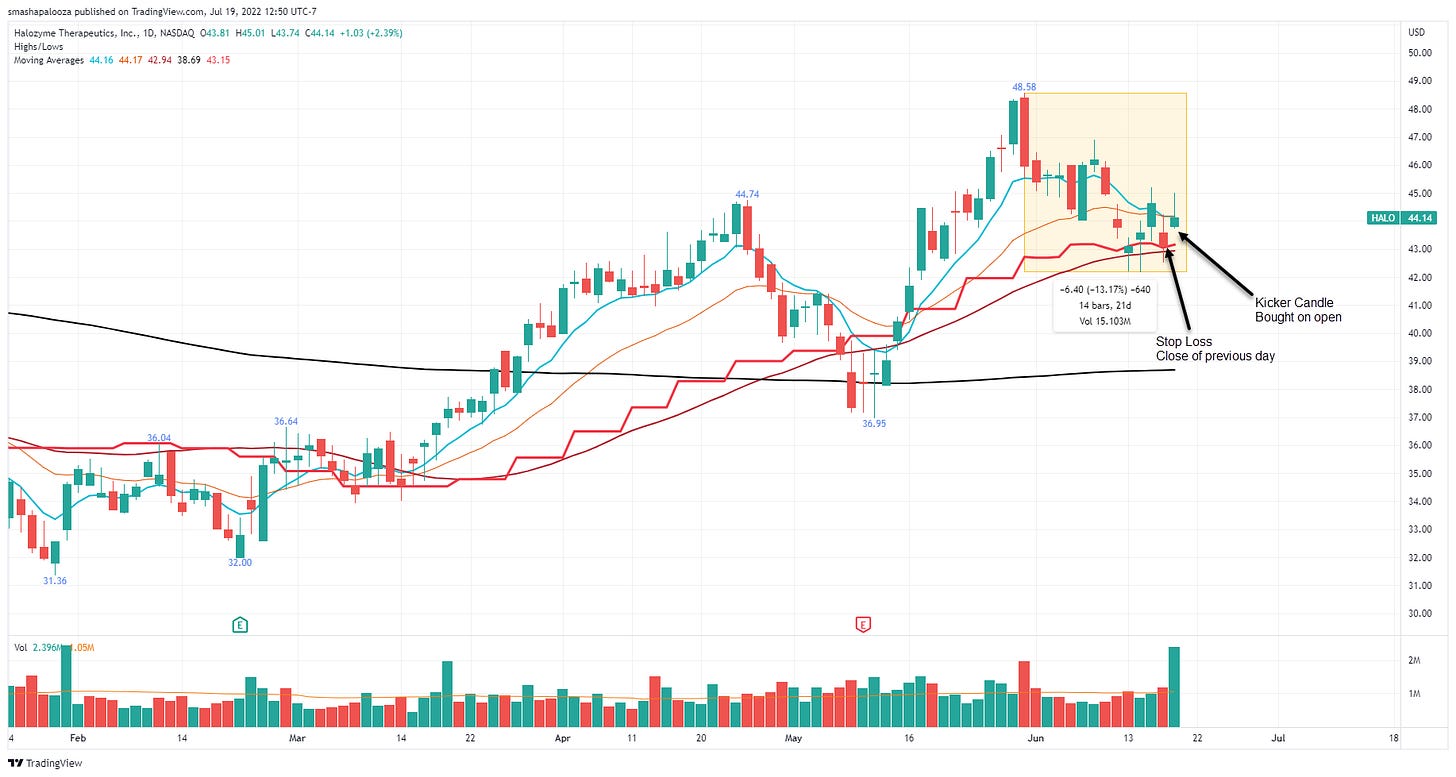

A flat base is defined as a consolidation formed over a minimum of 5 weeks that has a depth of no more than 15%. HALO’s flat base was textbook, at 5 weeks and only 13% deep. Another positive during HALO’s base was that the two largest volume weeks were both green.

Looking back in hindsight it’s easy to see where you should have bought a stock or sold, but doing it in real time is a whole different ball game. I’ll walk you through my thought process on HALO that allowed me to get positioned before it’s breakout.

HALO was on my watchlist due to its tremendous relative strength and prior uptrend of 31%. After a stock has made a move higher and then completes it’s first down week it’s time to start watching for a base to form.

Knowing that a flat base needs 5 weeks to form and could only be 15% deep to be valid, I saw an opportunity for a low risk entry on HALO. At this point, we were 3 weeks into a basing structure that had only corrected 13% and was getting support right near its 50 day and 10 week moving averages. If this was going to form a flat base, I figured it was near the bottom of it.

I used my thesis of a flat base forming and a kicker candle to initiate a position. I bought on the open and placed my stop loss at the close from the previous day.

HALO then formed a great three touch trendline and broke right through it the next day. I however didn’t add to my position here though due to exposure rules, but if you missed the kicker you had a second chance.

HALO went on to finish forming its 5 week flat base all while not testing my stop from my initial purchase. After finding support at its 50 day and 10 week moving averages once again, HALO had a surge of volume come in and broke out from the flat base in textbook fashion.

Knowing the weakness of the general market and how many breakouts have been quick to fail I didn’t add to my purchase yet. Instead, I waited to see if a Failed Breakout Pullback to the 21 ema would occur. This was a setup had just completed a deep dive on. I bought slightly above the 21 ema, but could have been more patient and waited for the actual touch.

Based on my study of the Failed Breakout Pullback when the set up works, stocks only drop about 2% lower than the 21 ema and on average are 6.4% higher one week later. Exactly one week after the Failed Breakout Pullback entry HALO has only dropped .64% below it’s 21 ema and is 6.79% higher.

So far HALO is exhibiting all the characteristics of a winning stock, but only time will tell.

If you enjoy my work please share and subscribe. You can also follow me on Twitter @smashapalooza16

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.