The Market:

Monday’s session opened relatively quiet with the Nasdaq testing its 8 ema and closing about midway through its range. Tuesday the sellers were in control as both the Nasdaq and the S&P500 dropped to their 50 day moving averages. While both days were down, the Nasdaq managed to hold onto net highs, showing strength under the surface. Earnings reports after the bell on Tuesday sparked a big overnight rally with the Nasdaq gapping up over 1.5% leading into the highly anticipated FOMC meeting. The Fed decision was inline with expectations of a .75bps raise in interest rates, however the dovish tone of Chairman Powell in his press conference hinting at pausing rate hikes in the future sent the market even higher with Nasdaq ending the day up 4%. While the FOMC was the highlight of the day we still have more mega cap earnings and key economic numbers coming out the rest of the week with GDP on Thursday morning and the PCE inflation index on Friday.

Current Portfolio:

CELH – Consolidating near highs, has a mini coil set up.

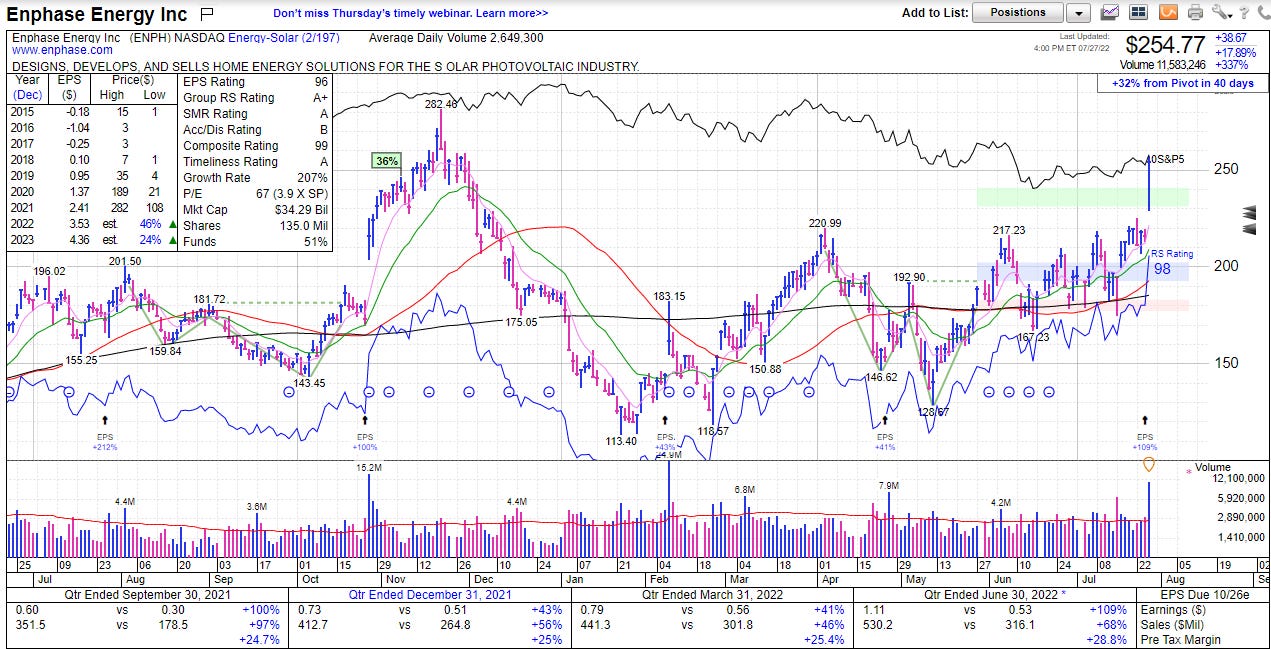

ENPH – Bought on the open Wednesday after a strong earnings gap up.

HALO – Consolidating near highs, weekly mini coil set up still valid.

LI – Bought near the open on Monday as it tested its 10 week average. Still consolidating in that range.

LNTH – Triggered a mini coil buy after the Fed announcement.

OLPX – Consolidating just below the prior highs from the left side of the base, light volume on the pullback. Possible handle forming.

Actions taken:

Sold: GTLB

Bought: ENPH, LI, LNTH

Potential Leaders:

BOX, CELH, DLO, ENPH, EVH, FNKO, GTLB, HALO, LI, LNTH, OLPX, OPCH, PRVA, SEDG

With a broad rally in the indexes on the back of mega cap earnings and the Federal reserve most of the potential leaders took part however it was ENPH that was the real star of the day gaining over 17% on the back of a monster earnings report. The coming days will be telling, if these leaders can continue to act well by following through or consolidating.

Actionable Ideas:

OLPX – Failed Breakout Pullback – ~ $16.25

OLPX took out the prior highs of $17.37 from the left side high of its current base. Will be watching now for a to pullback to the 21 ema.

CELH – Mini Coil – $86.46

CELH has formed a mini coil near recent highs. The decreasing volume while it consolidates is a positive.

LI – 10 Week Pullback - ~ $33.70

LI continues to consolidate near its 10 week moving average after running up 120%.

If you enjoy my work please share and subscribe. You can also follow me on Twitter @smashapalooza16

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.