What a week. The Nasdaq finished up a little over 2% on increasing volume. The week started weak with the index falling below its 21 ema and two distribution days, however que Jerome Powell on Wednesday to ignite a rally. As widely expected, Powell stated that the Fed could begin slowing the pace of interest rate hikes as soon as the December meeting. And while that was welcome news, I believe it was this statement “if you are waiting for inflation to go down, it’s very difficult not to over tighten” that really got the market going.

Thursday turned into a day of digesting gains as we waited for Friday’s non-farm payroll and unemployment data. Both numbers came in hot, and the markets gapped down and had every reason to keep going lower, however buyers stepped in and the indexes closed near the highs virtually unchanged for the day. That is a big character change from previous times the market has gapped down on hot economic reports this year.

The Nasdaq also saw its 50 day moving average move into an uptrend and the 10/26 distribution day also has fallen off due to enough time passing. This lowers the current distribution day count down to 2.

The SPX remains in a Power Trend and managed to close above the 200-day moving average for the first time since April. After being in no man’s land for weeks between the 50% and 61.8% Fibonacci retracements the SPX looks to have made up its mind and push higher. Most encouraging was Friday’s action, as the SPX undercut and then rallied above the 200-day moving average. We are however, up against a long trendline from all time highs that could act as major resistance.

The dollar continues to fall and has sliced through its 200-day moving average. Yields also continued lower this week with the 2-year breaking below the 10-week and 50 day moving average, while the 10 year could have a meeting with its upward sloping 200-day moving average. The VIX has fallen very rapidly down to levels not seen since the beginning of the year. All of this is encouraging for equities. The bulls will need these to continue going lower.

Friday’s Breadth

Before we dive into my market outlook, current positions, and trading plan make sure you are subscribed so that you don’t miss any future updates!

Next week is relatively quiet on the economic front, as far as the Fed is concerned. We will receive some inflation data on Friday however with the PPI report.

I continue to be bullish on the market and expect further upside from here. As I mentioned before stock’s are breaking out of proper bases and so far holding these breakouts. There is no immediate distribution and failure, a major change in character from the rest of the year.

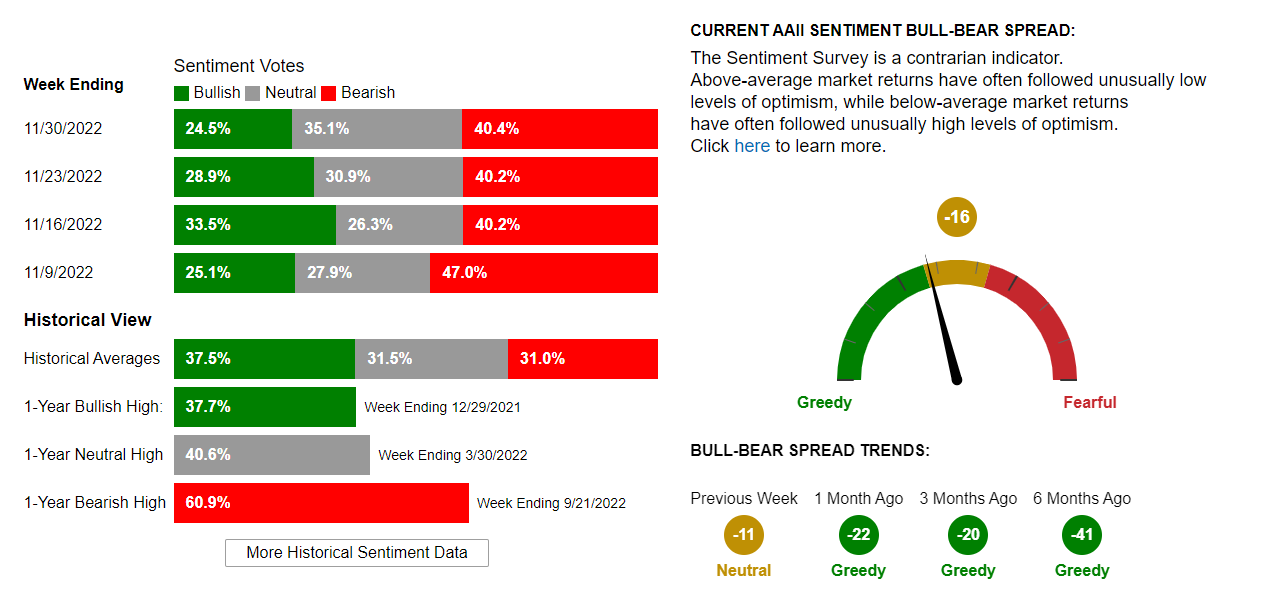

Like last week let’s look at the AAII to get a gauge on investor sentiment. This week’s bearish number increased to 40.4% while the number of bullish participants dropped to 24.5%. The neutral view increased the most to 35.1%. While this is only a secondary indicator, it makes me more bullish that overall bullish sentiment is still dropping, and bearishness is increasing. The crowd is often wrong when it comes to the market.

Current Positions: ANET 0.00%↑ ENPH 0.00%↑ GFS 0.00%↑ LULU 0.00%↑ ON 0.00%↑ PODD 0.00%↑

Overall, the action in my portfolio was constructive this week. After patiently waiting for what felt like weeks I was finally able to initiate a position in GFS.

ANET 0.00%↑ – Closed down a fraction this week on light volume but now has 3 tight weekly closes. Overall healthy and controlled action.

ENPH 0.00%↑ – Finally managed to break out into new all-time highs. Volume was well above average on the breakout, and I added to my position as discussed in Thursday’s newsletter.

GFS 0.00%↑ – After breaking out of a cup base 2 weeks ago, GFS finally pulled back to the 21 ema where I initiated a position. While the weekly candle isn’t great this had multiple upside reversals this week and the overall action remains strong.

LULU 0.00%↑ – Closed the week near the highs on average volume. This pushed above its weekly trendline and now has been up 9 days in a row. Earnings are coming up next week, however. I should have enough cushion to hold into the report.

ON 0.00%↑ - Continues to consolidate right below all-time highs as it forms a handle. ON now has 3 tight weekly closes as well. Volume was light this week and the action remains constructive.

PODD 0.00%↑ – Began pushing back up towards all time highs as it reclaimed the Livermore $300 level. This pushed nicely above a multi touch trendline and closed the week near the highs.

Watchlist: https://www.tradingview.com/watchlists/84325802/

My focus remains on finding additional low risk entries in the coming days and weeks to size up into my current holdings. As always risk management is the number one goal so I will keep an eye out for any red flags.

The one that got away, for now. After being shaken out and missing my reentry on the 23rd this broke out into new all-time highs on Friday. CELH still trades in very wide ranges, and I would like to initiate a position on a pullback towards the 21 ema.

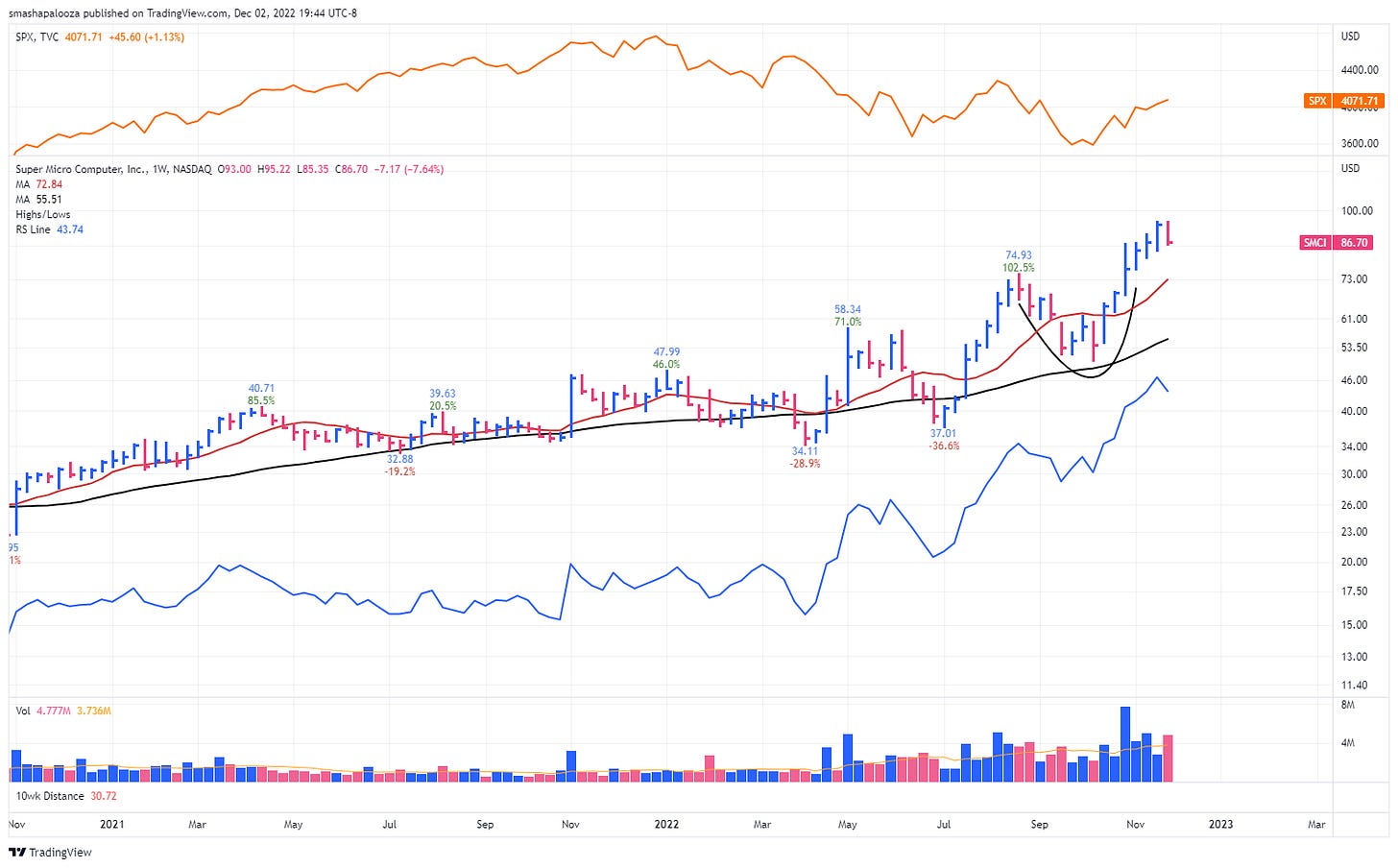

This has the makings of a market leader. While I missed the initial breakout on its earnings gap up, I will now be watching this to pull back to the 10-week moving average. It may not happen for a few weeks, but this will remain on my radar and I will be a willing buyer when it does.

Stocks listed in Next Weeks Plan are stocks with strong fundamentals and showing good technical action that can offer a low-risk entry. Not every entry will trigger, but also just because a stock is listed here does trigger does not mean I will take the trade. Portfolio exposure, market health and other factors will also be considered.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.