The market has been at a standstill for the past few weeks, with neither the bulls nor the bears taking control. For the third week in a row, the market has closed at pretty much the same spot, causing frustration for both. However, there are some signs that it wants to move higher.

Before we keep going make sure you are subscribed so that you don’t miss any future updates!

One of these signs is the price action of the Nasdaq itself. This week we saw morning gap downs being bought as the Nasdaq found support at its 21 exponential moving average, which is common in up trending markets. While the overall price action looks healthy, breadth remains a concern. The index has been moving up to sideways in price, but we continue to see net lows.

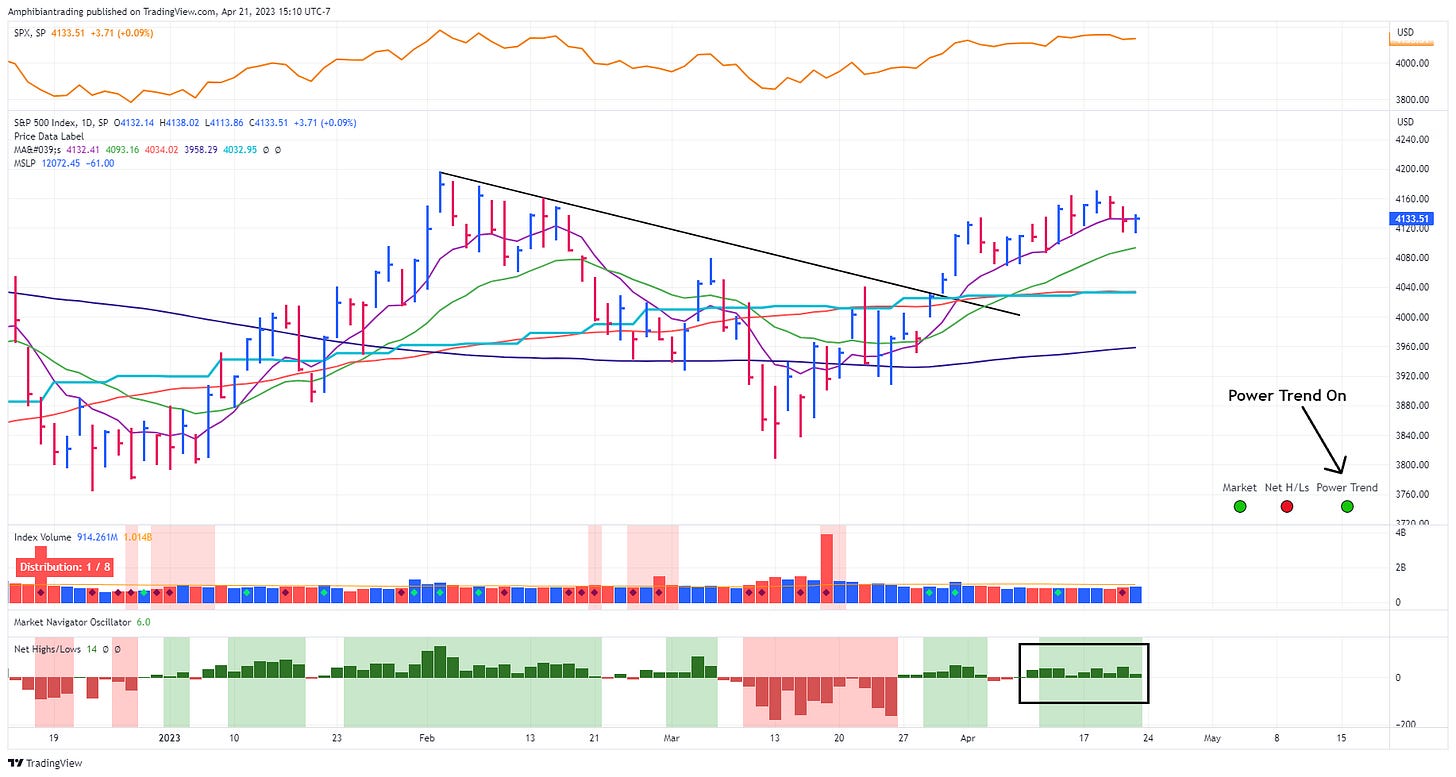

The S&P, on the other hand, appears to have more broad-based participation. The NYSE has had net highs for 10 days now, and on Tuesday, the S&P triggered a Power Trend, as shown by the Market Stop Light Indicator.

Additionally, the VIX is making new lows, closing at levels it hasn’t seen since January of 2022. While many may expect a pullback and a spike in the VIX, it's important to note that prior uptrends in the past have seen the VIX trading much lower than current levels for a sustained period of time.

While the market remains uncertain, some stocks stand out as potential leaders and they should be closely monitored for clues to see if the bulls or the bears will take the upper hand. To see those leaders as well as potential actionable ideas for next week watch the video below.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.