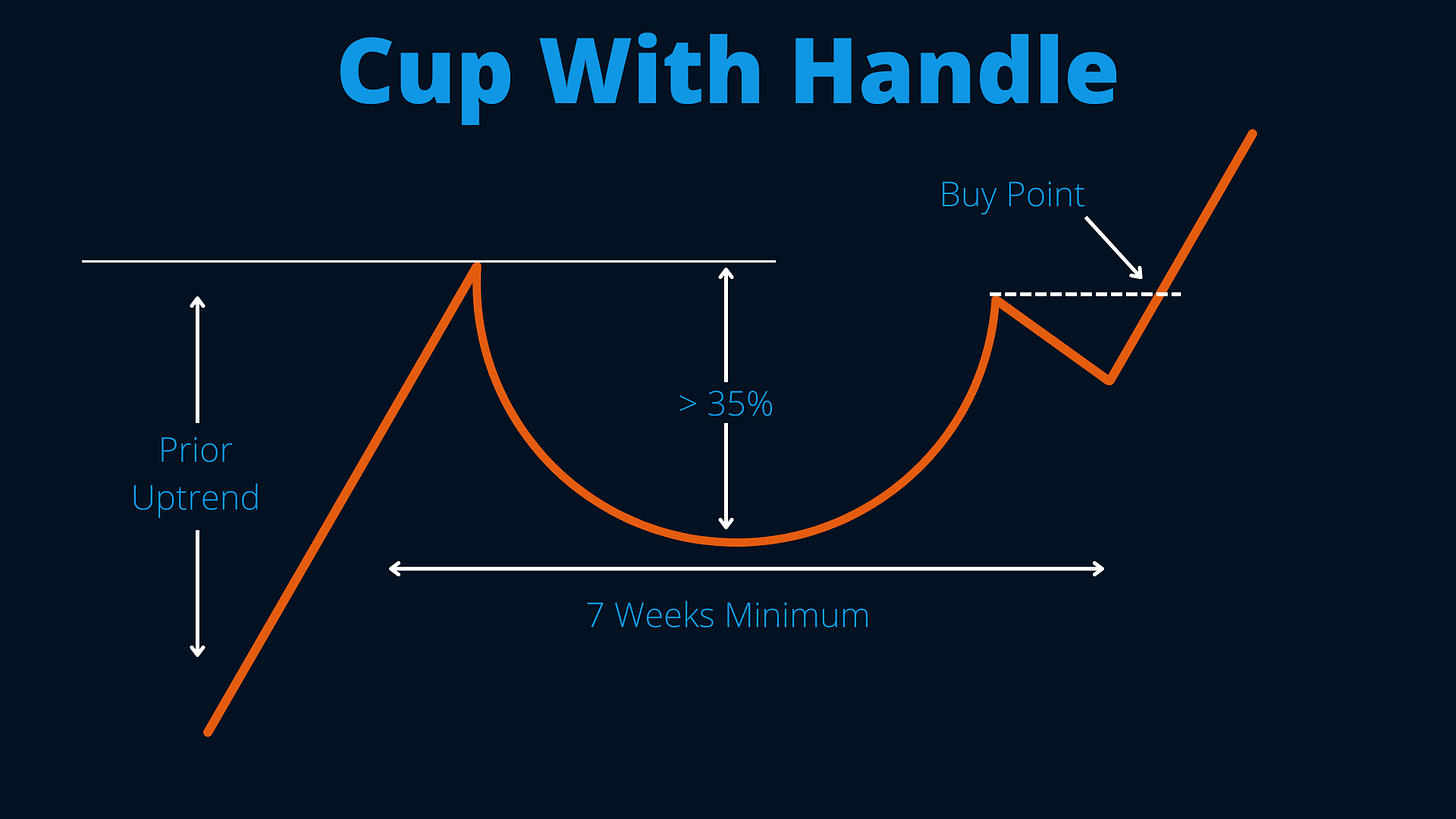

The Cup with Handle pattern defined by William O’Neil is one of the easiest patterns to recognize on a chart due to its resemblance of a teacup viewed from the side. While it is easy to spot on a chart, not all Cup with Handles are created equal.

The characteristics of a proper Cup with Handle are as follows:

Shape looks like a teacup

Minimum length: 7 weeks

Depth in base: 20% - 35%, can be as deep as 50% in severe bear markets

Preferably “U” shaped rather than “V”

Handle forms in upper half of base and drifts downward

Handle length: 1 week minimum

Midpoint of handle is greater than midpoint of base

Like all basing patterns you want to see a prior uptrend of at least 30% before the Cup with Handle forms, along with tight closes in the base, a symmetrical shape, big volume on up days and weeks, and overwhelming volume on the breakout.

Being able to spot the difference between a proper Cup with Handle and a faulty one could be the difference between a winning and losing trade. The devil is in the details.

Before we dive into my current portfolio and actionable ideas, make sure you are subscribed so that you don’t miss any future updates!

Let’s examine some faulty cup with handles and spot how you could have avoided them.

Faulty Cup With Handles

MED 2010: The shape of the base resembles a “V” more than a “U” and is unusually deep at 57%. The base also has wide and lose bars that close near the lows on big volume.

HPQ 2003/2004: There is one very large red candle that sticks out, the volume is the largest volume in quite some time, and it closes at the dead low of the week. There are more distribution bars in the base and finally the handle wedges up rather than drifting lower.

BSX 2004: The base is not symmetrical as it has 7 weeks down and then 1 week straight up from the bottom. All the larger volume in the base is also distribution weeks. BSX never actually broke out from it’s flawed Cup with Handle.

ISRG 2006: The overwhelming volume is on the left side of the base in the form of distribution with wide and loose bars closing near the bottoms of the range. The handle also forms in the lower half of the base and the handle midpoint is less than the cup midpoint. The stock tries to breakout, but ultimately fails.

Now let’s look at proper Cup with Handles and compare.

Proper Cup With Handles

DECK 2006: DECK had a nice prior uptrend before forming a proper 18-week, 25% deep Cup with Handle. In the base there are many supporting weeks that close well off the lows in the upper half of the bar and show tight weekly closes. The higher volume weeks are all positive, the handle drifts lower and big volume comes in as the stock breakouts above the handle.

AAPL 2003/2004: Coming out of the 2000-2003 bear market AAPL formed a proper Cup with Handle. After a nice prior uptrend, AAPL formed a 20 weeklong, 23% deep base. The base had numerous tight weekly closes and massive volume on the breakout signifying overwhelming demand.

ROKU 2020: Coming out of the Covid bear market, ROKU formed an 8-week, 28% deep Cup with Handle. The accumulation bars are overwhelming, and a clear sign of the stock being bought week after week. The base also has tight weekly closes, while the handle has a shakeout that closes near the highs before breaking out the next week on thunderous volume.

While the shapes are similar not all Cup with Handles are created equal, it is imperative to train your eye to spot the differences between a proper and faulty Cup with Handle. Going through bar by bar is a great exercise to do this.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.