Matt Caruso is a full time trader and teacher who in the 2020 US Investing Championship achieved a 346% gain. Matt currently offers his Active Growth Investor Course through his website Caruso Insights and it is hands down one of the best, if not the best trading educations you can find.

Something Matt teaches in his course are Tactical Entries, or ways to get into a stock while having a favorable risk to reward ratio without buying another obvious breakout.

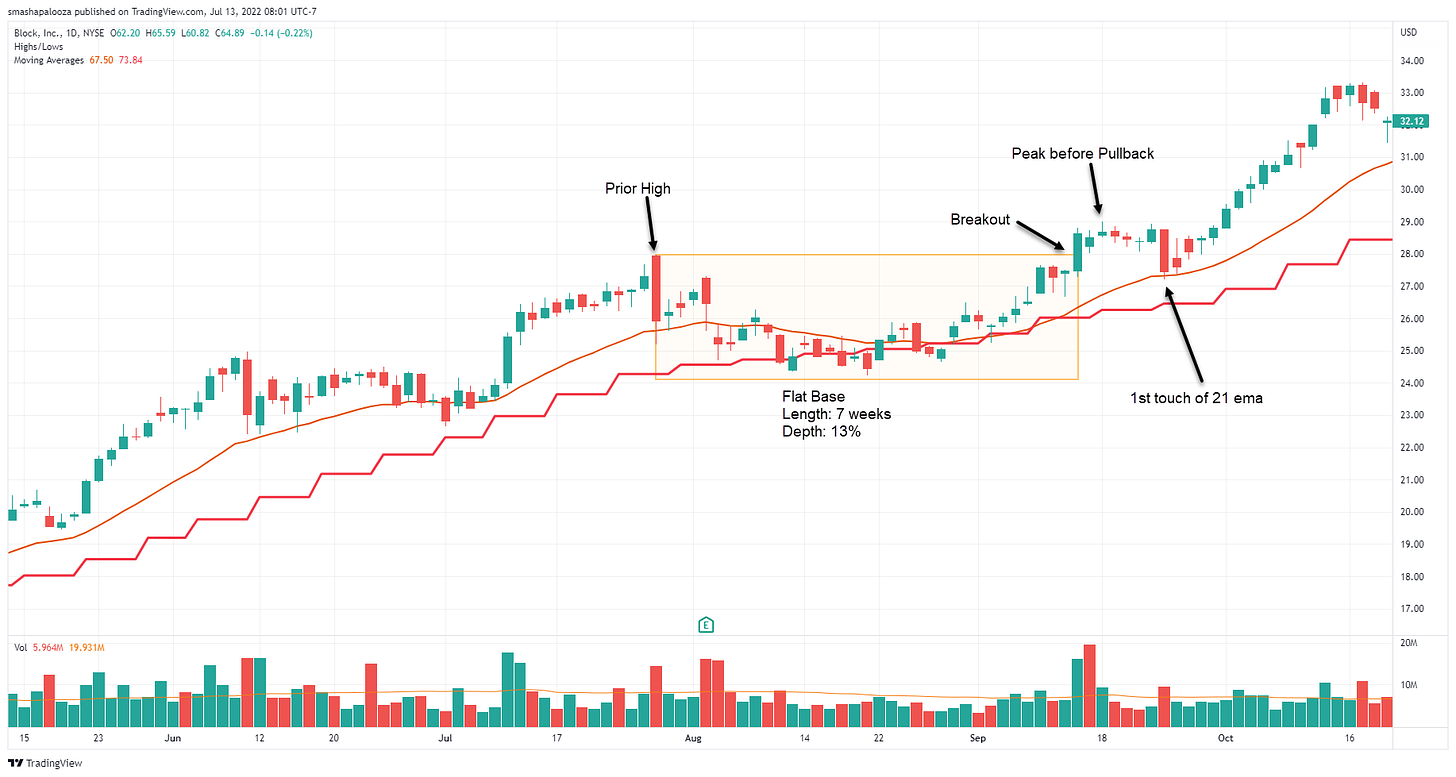

One of those Tactical Entries is the Failed Breakout Pullback to the 21 EMA.

I went and studied over 150 bases on true market leading stocks to see how many Failed Breakout Pullback’s occurred and what was the difference between the ones that worked and didn’t.

Before we dive in make sure you are subscribed so that you don’t miss any future updates!

To start I had to define what exactly the criteria for this tactical entry should be. This is the definition I landed on.

A pullback to the 21 ema within 10 trading days of the stock breaking above prior highs from the left side of a base. Must be price high from left side of base, not a handle area.

Of the 157 bases I studied 45 (29%) had a Failed Breakout Pullback that met my definition.

Of the 45, 25 or 55% would have not triggered your stop loss assuming you used the simple 5% stop below the 21 ema Matt teaches in his course.

Winning Trades

Looking at the 25 trades that did not trigger a stop loss, it took an average of 6 days to drop back to the 21 ema, with the average drop below the 21 ema being only 1.76%. The average drop from the peak before the pullback down to the 21 ema was 8.37% while the 21 ema was on average 4.51% below the prior high breakout level.

Looking at where the stock was in it’s lifecycle also shared some interesting information. 1st and 2nd stage bases had the most successful Failed Breakout Pullback’s, while a 4th stage base had more than a 3rd stage base. 5th and 6th stage bases did not have a single successful Failed Breakout Pullback.

The risk reward ratio was also something that was very positive to see. Assuming you stuck with the 5% stop loss, on average you were sitting with gains of about 15% after 4 weeks and an average gain of 25.76% after 8 weeks.

The favorable risk to reward ratio paired with a 55% success rate is a winning combination that makes this tactical entry very powerful.

Trades That Triggered A Stop Loss

While 55% of the Failed Breakout Pullback entries resulted in winning trades, 45% triggered a stop loss.

Of the trades that would have triggered a stop loss it took about 6.25 days to get back to the 21 ema with the average drop below the 21 ema being 8.62%. The average drop from the peak before the pullback down to the 21 ema was 9.44% while the 21 ema was on average 5.22% below the prior high breakout level.

Comparing the Winners vs. Losers

Comparing the winning trades to the ones that got stopped out a couple of things stick out. First, the winning trades peak back down to the 21 ema was not as high as the trades that triggered stop losses. The losing trades averaged a range of over 18% if you measure the peak to the average drop below the 21 ema. Talk about volatility.

Secondly, the winning trades see the 21 ema’s price closer to the breakout level than the losing trades. The 21 ema was on average only 4.51% below the breakout level for winning trades while it was 5.22% below the breakout level on stopped trades.

Conclusion

The Failed Breakout Pullback is a very powerful entry tactic that can provide a great risk to reward set up. With a favorable success rate and multiples of risk being achieved it is a tool that every trader should have in their arsenal.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.