The Market:

Monday started off strong with the Nasdaq gapping above its 50 day moving average, somewhere it hasn’t been since April. However, in typical bear market fashion the gap up was sold and it closed down on the day. With the expectation of lower prices from there, the market does what it likes to do best, fake out the majority and staged back to back follow through days (a gain of over 1.25% on increasing volume) reclaiming the 50 day moving average and closing above it. The Nasdaq didn’t stop there as it added to gains on Thursday causing the 50 day moving average to go into an uptrend while also having the 21 ema cross above the 50 day. After 3 days of solid gains, Friday punished anyone who chased extended stocks buying out of FOMO. The pullback was not unexpected after the Nasdaq ran up just under 10% in 5 trading days, however under the surface the Nasdaq managed net new highs still and volume came in lower than Thursday.

Net new highs managed to be positive all week. Monday ended a 25 day streak of net new lows and the Nasdaq now has a 5 day streak of net new highs.

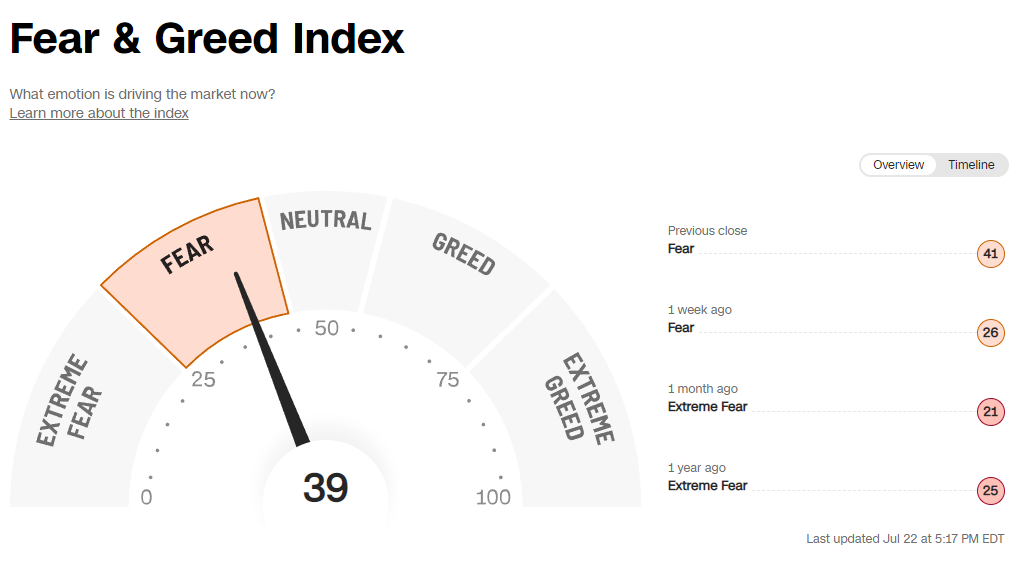

Secondary Indicators:

Put Call Ratio: Neutral reading at .99

Percent of Stocks above the 50 day: Nasdaq - 63% S&P - 55%

Percent of Stock above the 200 day: Nasdaq - 21.5% S&P - 20%

Looking Ahead To Next Week:

Next week could prove to be a pivotal week for this rally attempt. With the FOMC meeting, PCE inflation index data and earnings from companies such as AAPL, GOOGL, and AMZN we will certainly find out if this rally is going to have legs or just roll over and continue lower.

Current Portfolio:

CELH – Tight weekly close in the upper half of its range suggesting supporting action.

GTLB – Closed positive on the week with light volume, still consolidating.

HALO – Tight weekly close on low volume, consolidating right above it’s recent breakout level. Formed a weekly mini coil.

OLPX – Broke out of a 7 week cup base closing the week just above its pivot point. Watching for a potential Failed Breakout Pullback to the 21 to add to existing position.

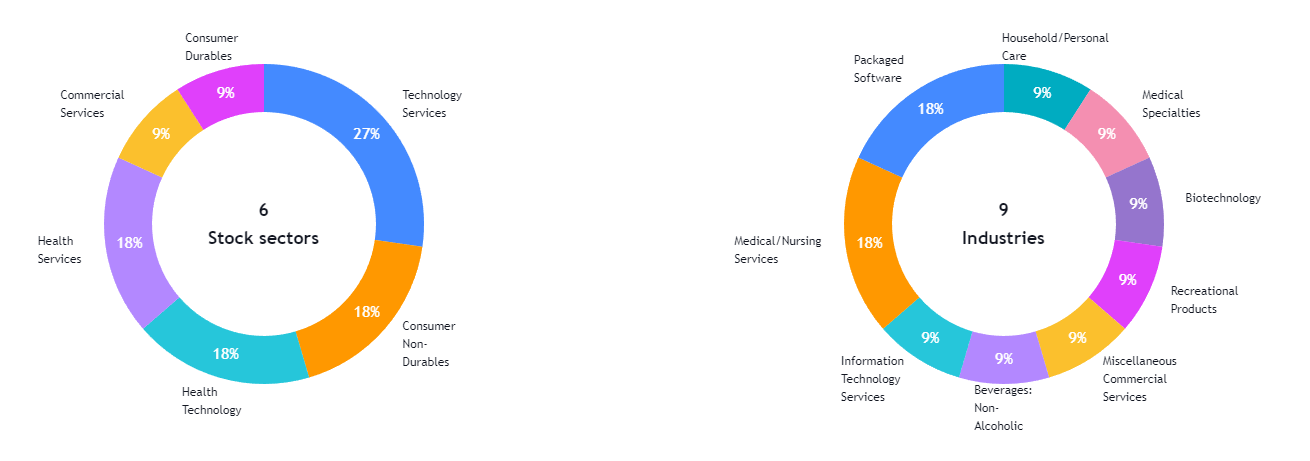

Potential Leaders:

BOX, CELH, DLO, EVH, FNKO, GTLB, HALO, LI, LNTH, OLPX, OPCH, PRVA

https://www.tradingview.com/watchlists/84325802/

Actionable Ideas:

OLPX – Failed Breakout Pullback - ~ $16.20

Broke prior highs of its cup base on 7/20. Now on watch for it to pullback to its 21 ema within 10 trading days.

LNTH – Failed Breakout Pullback - ~ $67.75

Broke prior highs of its cup base on 7/20. Now on watch for it to pullback to its 21 ema within 10 trading days.

OPCH – Failed Breakout Pullback - ~ $30.15

Broke prior highs of its cup base on 7/15. Now on watch for it to pullback to its 21 ema within 10 trading days. Earnings next week could be a problem as there won’t be much time to build a cushion to hold through the report. OPCH did breakout of a mini coil Friday, which was also an actionable buy.

LI - High Tight Flag / 10 Week Pullback - $41.49 / ~ $34.00

After running up 120%, LI formed a high tight flag with only an 18% correction. The length of the flagpole is getting extended now at 4 weeks. With all eyes watching this one, I’ve noted a shakeout seems inevitable. A touch of the 10 week moving average could provide a low risk entry.

You can also follow me on twitter @smashapalooza16

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.