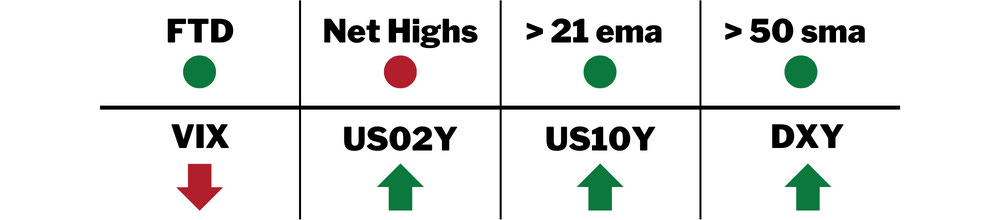

Compared to last week the market had a relatively quiet week with the Nasdaq finishing down 1.57% and the SPX down 0.69%. While the indexes were down for the week volume was light and there was plenty of constructive action that took place. To start, the Nasdaq improved its structure by putting in another higher high and higher low. It also remains above the 21 ema which has now crossed back above the 50-day moving average.

The SPX also notched a higher high and higher low after bouncing off the 8 ema on Friday. For now the index remains stuck between the 50% retracement and the 61.8% retracement from this third leg down. The 61.8% retracement also lines up closely with the big 4000 psychological level so resistance there isn’t unexpected.

The dollar has continued to fall, making another low this week. It appears to be forming a potential bear flag and a test of the rising 200 day moving average still seems likely. Yields remain mixed, with the 2-year finding support at the 10-week moving average and bouncing, while the 10 year continues to fall and is stuck below the 10 week and 50 day moving average. The VIX also continues to steadily decline. The bulls will need to see more weakness in the dollar and yields if this rally attempt is going to continue.

Before we dive into my market outlook, current positions, and trading plan make sure you are subscribed so that you don’t miss any future updates!

Next week is a short trading week due to the Thanksgiving holiday, but just because the market is closed Thursday and Friday is a shortened trading session doesn’t mean we don’t have plenty of important economic data.

The reports I will be watching most closely include Wednesday’s Durable Goods Orders, Initial Jobless Claims, New Home Sales and the FOMC Minutes.

At this point, I am bullish on the market to continue rallying from here. How far this rally will go I don’t know, but we have tailwinds from CPI and PPI reports coming in well below expectations, the Mid-term elections are behind us, seasonality and there is still a lot of bearish sentiment. Below is the AAII sentiment survey, this week the 40.2% of participants were bearish, well above the 31% historical average and the 33.5% of participants that are bullish.

From a technical perspective, I can see further upside as well. If we look at the previous rally attempt from June to August, the SPX rallied roughly 19% before coming down to make new lows for the year. During that rally we saw many stocks like AEHR, CELH, ENPH, PI, TMDX to name a few have massive moves of close to 100% or more. The difference between now and then is that when these stocks and many others made those major advances they didn’t come from proper bases. If you look now, while the market was correcting to new lows, many stocks were forming proper bases. Some are still forming bases while others have already broken out.

Current Positions: ANET 0.00%↑ , CELH 0.00%↑ , ENPH 0.00%↑ , LULU 0.00%↑ , ON 0.00%↑

As a whole I was pleased with the overall action of my positions this week. While I was stopped out of MELI and MBLY I was able to initiate new positions in CELH and ENPH.

ANET 0.00%↑ – Finished the week right on the highs and above the weekly downtrend line. Volume was below average, but price action remains strong.

CELH 0.00%↑ – Continues to build the right side of its base after reclaiming the 10-week moving average last week on heavy volume. This is stuck in a channel still and battling with the Livermore $100 level.

ENPH 0.00%↑ – Attempted to breakout of its cup with handle base again but closed below the pivot, although up on the week. The $313 level seems to be where supply is waiting, if this can finally break that seller it should be ready to go. Overall structure is still intact.

LULU 0.00%↑ – Closed the week lower on light volume but acting fine. There is a gap below from the breakout day. Ideally that gap remains unfilled and price pushes higher, but the way this market has treated breakouts a gap fill wouldn’t surprise me.

ON 0.00%↑ - Closed the week lower on lighter volume closing right in the middle of the weekly range. This found support nicely at the 21 ema earlier in the week and bounced from that level.

Watchlist: https://www.tradingview.com/watchlists/84325802/

I have started building positions in 5 quality stocks that I feel could be potential leaders. My focus will be on finding additional low risk entries in the coming days and weeks to size up into those. If the market does continue to rally and my current positions progress, I will be watching the following stocks for entries to potentially add to my portfolio.

One I am currently holding but continues to build the right side of its base after reclaiming the 10-week moving average last week on heavy volume. This is stuck in a channel still and battling with the Livermore $100 level. If this can push through the upper channel line it would be a nice low risk spot to initiate a position. I won’t be adding here just yet though.

CLFD had a monster earnings gap on Friday and honestly should have been bought on the open. I passed on this trade Friday, but the day’s action has it on my radar. It just completed its 13th week of a double bottom base. $125.83 would be the standard pivot, although I would like to see a few days consolidation or a retest of a short term moving average to provide a low risk entry. If this does form an entry I like, I will be sure to include it in my daily plan.

Another one I am already holding but still offers a low-risk entry if you are not already in it. This Attempted to breakout of its cup with handle base again but closed below the pivot. The standard cup with handle pivot was $316.87 however, $313 seems to be where supply is waiting. If this can finally break that seller it should be ready to go. Overall structure is still intact.

GFS is a young IPO that has finally formed its first proper base. The weekly chart shows tons of accumulation and a strong volume profile. This broke out of a 13-week 29% deep cup base this week and closed right at the highs. I will be watching this to pullback to the 21 ema at some point next week. It may not happen, but if it does, I will be ready to pounce. This is my favorite idea going into this week.

MELI continues to act well and now has a cup with handle pattern on the weekly chart. Despite being stopped out of this earlier in the week, the overall price and volume action remains strong and I wouldn’t mind getting back in if a low risk entry presents itself. Friday offered the chance with a kicker pattern, but I didn’t take the trade. If this does form an entry I like, I will be sure to include it in my daily plan.

TMDX broke out of a cup base with a powerful earnings gap up 2 weeks ago and has been consolidating right near the left side high of the base for 2 weeks now. Volume has been well below average as it consolidates. This triggered the kicker pattern Friday that I mentioned in Thursday’s newsletter and going into next week there is the opportunity for another kicker. A gap up above $57.03 (Friday’s opening price) would trigger the kicker pattern. Stop would be at today’s low or closing price depending on how much risk you want to take.

Stocks listed in Next Weeks Plan are stocks with strong fundamentals and showing good technical action that can offer a low-risk entry. Not every entry will trigger, but also just because a stock is listed here does trigger does not mean I will take the trade. Portfolio exposure, market health and other factors will also be considered.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.