The markets finished a seasonally strong week down but not out. While the Nasdaq remains the weakest index, falling close to 2% for the week, the SPX managed to close the week pretty much unchanged, down less than a quarter percent with a weekly upside reversal bar. (more on those linked below)

As I noted last week, I was looking for the SPX to find support at the 50% Fibonacci retracement level. Monday, Tuesday, and Friday the lows were right around that level, while Thursday the index pierced below it but managed to close back above it.

If you want to be optimistic you could argue that the SPX and the Nasdaq have put in a higher high and a higher low, however the 21 exponential moving averages are now sloping downward. I will be focused on the 50% Fibonacci retracement as a key level and will want to see that it continues to act as an area of support.

Before we dive into my market outlook, current positions, and trading plan make sure you are subscribed so that you don’t miss any future updates!

Current Positions: CELH ENPH INMD MEDP PI PODD

CELH 0.00%↑ – Continues to be strong and show relative strength as it has formed a classic cup with high handle base. Volume continues to be light.

ENPH 0.00%↑ – Closed below the 10-week moving average on light volume. Wednesday showed a powerful upside reversal on the heaviest volume for the week. Thursday and Friday’s action was disappointing. Having a lower cost basis, if this undercuts this weeks lows next week I will look to exit.

INMD 0.00%↑ – 6 weeks into a flat base on base bottoming pattern. Volume continues to be very light as this consolidates near the 10-week moving average. The weekly chart shows very nice accumulation since this stock bottomed in May.

MEDP 0.00%↑ – Showed very strong relative strength this week closing up over 3% while the markets were down. This is now 8 weeks into what could be considered a flat base, although it comes in slightly deeper than the 15% ideal depth. This formed a very nice upside reversal bar right off the 50 day moving average offering a nice low risk entry.

PI 0.00%↑ – One of the early leaders that broke out of a stage 1 double bottom base in October as the market attempted to bottom. This has formed a 3 weeks tight on the weekly chart and found support nicely at the 10 week and 50 day moving average area.

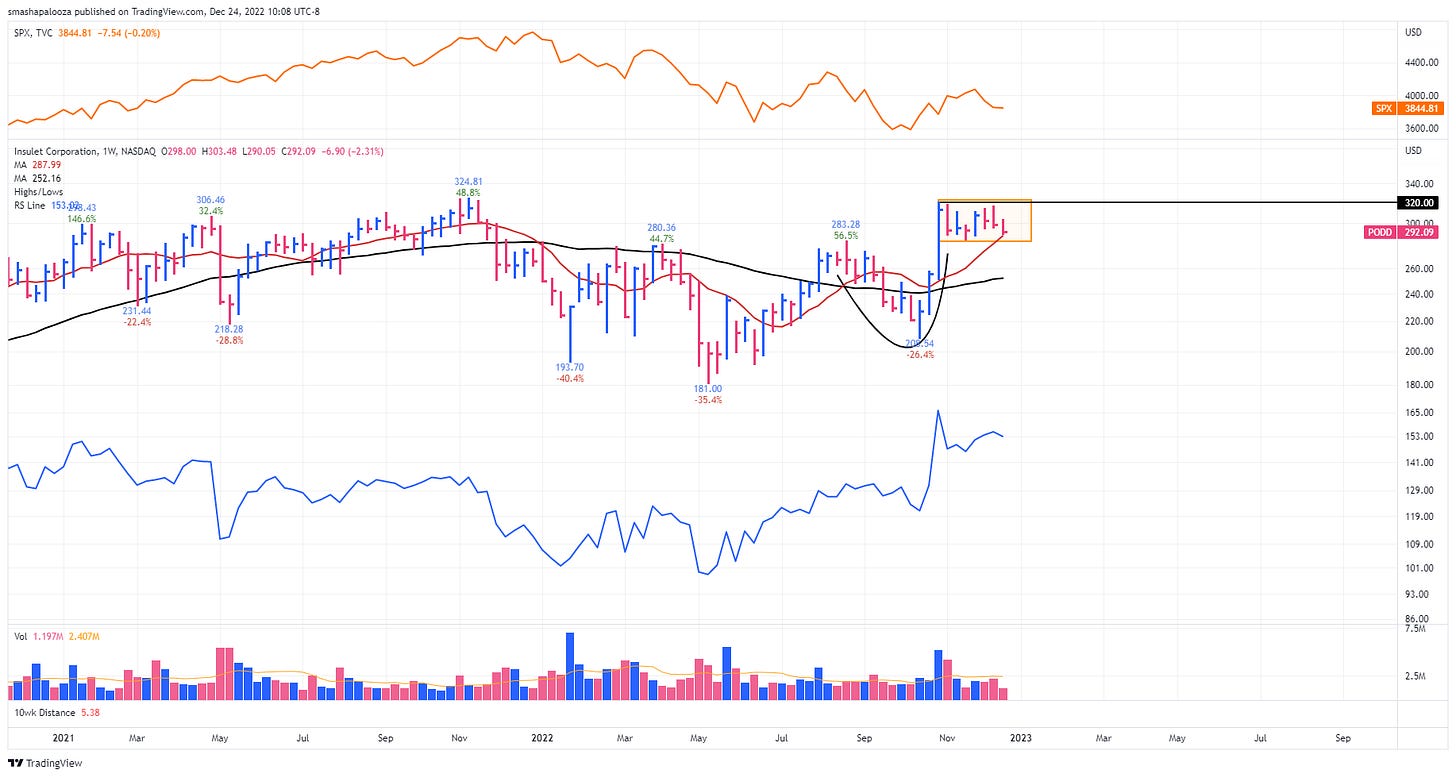

PODD 0.00%↑ – Completed the 7th week of a flat base. After launching higher from earnings this has gone on and formed a very nice flat base with a standard pivot of $320. The base is very healthy with volume drying up and tight weekly closes.

Watchlist: https://www.tradingview.com/watchlists/84325802/

With the market at a critical spot, I don’t plan on aggressively adding exposure until we can reclaim the 21 and 50 day moving averages. There are some decent set ups, but they will need some help from the market to work.

CELH continues to be strong and show relative strength as it has formed a classic cup with high handle base. Volume continues to be light. Rather than looking to buy a breakout, a touch of the 10 week moving average seems like a lower risk entry.

INMD is 6 weeks into a flat base on base bottoming pattern. Volume continues to be very light as this consolidates near the 10-week moving average. The weekly chart shows very nice accumulation since this stock bottomed in May. An entry near the 10 week moving average and the bottom of the flat base could present itself in the form of a Kicker on Tuesday morning.

PODD has formed a flat base after breaking out from its previous base on an earnings gap. The current base has only corrected 10% and has nice tight weekly closes. I will look to add to my current position in this on strength above the $320 standard pivot.

Stocks listed in Next Week’s Plan are stocks with strong fundamentals and showing good technical action that can offer a low-risk entry. Not every entry will trigger, but also just because a stock is listed here does trigger does not mean I will take the trade. Portfolio exposure, market health and other factors will also be considered.

Thanks for reading! If you enjoyed this article please help support my work by doing the following:

Follow me on Twitter @amphtrading

Share this post using the button below

The content presented is for informational and educational purposes only. Nothing contained in this newsletter should be construed as financial advice or a recommendation to buy or sell any security. Please do your own due diligence or contact a licensed financial advisor as participating in the financial markets involves risk.